I sat on a bus and watched two teenagers trade screenshots of a Roblox event like it was currency. You could feel the room tilt—this wasn’t the usual flash-in-the-pan moment. The platform had quietly become everyone’s evening ritual.

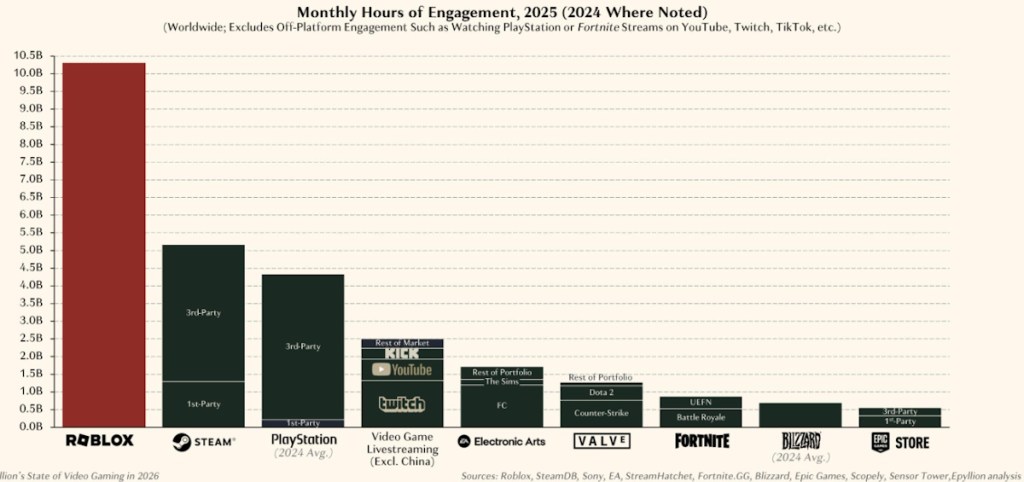

Roblox Hit 10 Billion Monthly Hours in 2025, Surpassing Steam and PlayStation Combined

A colleague messaged the chart before coffee and I almost dropped my mug.

I’ve been on Roblox for years, but the numbers in Matthew Ball’s State of Video Gaming report hit differently: Roblox logged more than 10 billion monthly hours in 2025, while Steam sat just above 5 billion and PlayStation averaged slightly over 4 billion, leaving Steam plus PlayStation near 9 billion. That gap isn’t a rounding error—Roblox cleared it with room to breathe.

How did Roblox reach 10 billion monthly hours?

At a coffee shop last week I saw a college kid open Roblox Studio between classes—that little moment tells you everything.

You don’t get ten billion hours from a single blockbuster. This is an accumulation: viral updates, persistent social hooks, and a creator economy that pays attention. Games like Grow a Garden and Steal a Brainrot exploded into massive engagement within months, and long-running experiences such as 99 Nights in the Forest and Brookhaven RP kept stacking hours without needing sequels. Roblox Studio, the platform’s algorithm, and the creator payouts combine to move small projects into massive audiences fast—like a living arcade that never closes.

Is Roblox bigger than Steam and PlayStation combined?

A publisher I respect summed it up bluntly: “They’re not selling games; they’re selling places to meet.”

Steam aggregates first- and third-party PC titles and Valve still dominates on desktop distribution. PlayStation captures console attention at scale for Sony. But Roblox’s advantage is scale and variety inside a single, user-driven ecosystem. When the algorithm promotes an experience, millions can join in hours. That’s a different kind of scale than a single-game launch—it’s social infrastructure plus content.

What changed in 2025 — one observation from the field

I visited a Roblox event that streamed like a mini-conference; the chat alone was its own economy.

The ingredient mix shifted: creators learned to turn updates into events, the platform refined recommendation signals, and cross-platform access widened sessions. The creator economy matured—Roblox payouts, sponsorships, and monetization tools made building viable for more developers. You’ll also see echoes of traditional gaming ecosystems: Steam’s catalog strength and PlayStation’s first-party franchises still matter, but Roblox’s open-ended content model and social loops created a persistent place players return to daily.

What this means for creators, players, and investors — observation then implications

On a forum a developer wrote that a small summer update doubled their concurrent users overnight.

If you build on Roblox, you’re in a market that prizes iteration and rapid scaling. For players, it means endless novelty and more social events. For investors, the metric shift—from revenue to attention—changes valuations; attention now flows to ecosystems that host constant interaction. Industry figures like Matthew Ball documented the attention metric precisely, and platforms from Epic to Unity will be watching how this attention converts to dollars and retention.

Quick practical notes — short observation, then what to watch

During an interview a community manager admitted they watch hours as closely as DAU.

Watch for three things: the quality of creator tooling (Roblox Studio), how recommendation algorithms surface new experiences, and whether monetization remains creator-friendly. If those stay aligned, hours will keep compound-growing. The next signal readers and stakeholders should watch is whether high engagement translates into diversified revenue streams for creators and platform holders.

I’ve told you what I see, and you’re living the metrics every time you open the app—so where do you place your bet on what holds attention next?